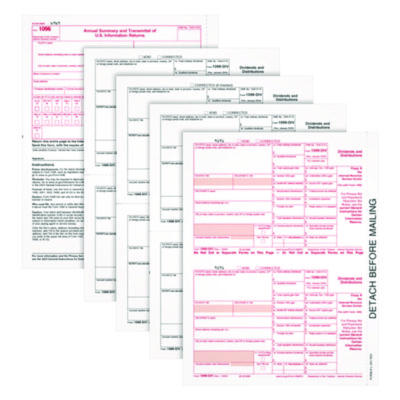

(TOP22973)TOP 22973 – 4-Part 1099-DIV Tax Forms with Tax Forms Helper, Fiscal Year: 2024, 4-Part Carbonless, 8 x 5.5, 2 Forms/Sheet, 24 Forms Total by CARDINAL BRANDS INC. (24/PK)

Detail gross dividends and other distributions valued at $10 or more with 4-Part 1099-DIV tax forms, 1096 summaries and access to Adams® Tax Forms Helper®. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-DIV data directly from Quick

$23.75

CompareWith 4-Part 1099-DIV tax forms, 1096 summaries and access to Adams® Tax Forms Helper®, filing couldn't be easier. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-DIV data directly from QuickBooks® Online or import your details from

1099-DIV sets for laser/inkjet printers, 1096 summaries and access to Tax Forms Helper®.

Use form 1099-DIV to report dividends and other distributions.

As of 2022, the 1099-DIV is a continuous-use form with a fill-in-the-year date field.

Micro-perforated, 4-part carbonless sets (Copies A, 1, B, and 2) with IRS scannable red ink.

Tax Forms Helper® with QuickBooks® connection—code and password enclosed in pack.

2023 IRS Law: if you have 10 or more returns, you must eFile—do so securely and easily with Tax Forms Helper®.

As of 2024, Copy-C has been removed by the IRS—use Helper to save digital copies, too!

Meets all IRS specifications—accounting software and QuickBooks® compatible.

(24/PK)

5280771 TOP 22973