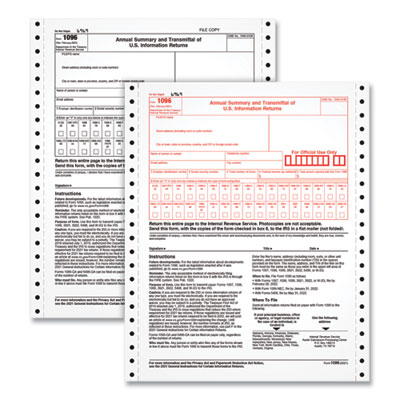

(TOP2202)TOP 2202 – 1096 Tax Form for Dot Matrix Printers, Fiscal Year: 2023, Two-Part Carbonless, 8 x 11, 10 Forms Total by TOPS BUSINESS FORMS (10/PK)

Use to transmit totals for 1097, 1098, 1099, 3921, 3922, 5498 and W-2G forms to the IRS. You'll need a 1096 for each form type submitted. Forms have scannable red ink and meet IRS specifications. QuickBooks and accounting software compatible.

$11.39

CompareTOPS™ 1096 Summary Forms transmit the totals for select information returns to the IRS. You'll use the 1096 to summarize your 1097, 1098, 1099, 3921, 3922, 5498 and W-2G forms. You'll need a separate 1096 for each type of form you file. Our acid-free pape

Includes 1096 summary and transmittal forms.

Use Form 1096 to submit the totals from information returns 1097, 1098, 1099, 3921, 3922, 5498 and W-2G to the IRS; each form needs its own 1096 cover.

Acid-free paper and heat-resistant inks help you produce legible, smudge-free, archival-safe records.

Scannable red ink required by the IRS for paper filing.

Meets IRS specifications; accounting software and QuickBooks compatible.

The 1096 Summary and Transmittal form is due to the IRS when Copy A forms for information returns are due; see IRS instructions for complete details.

(10/PK)

5927488 TOP 2202