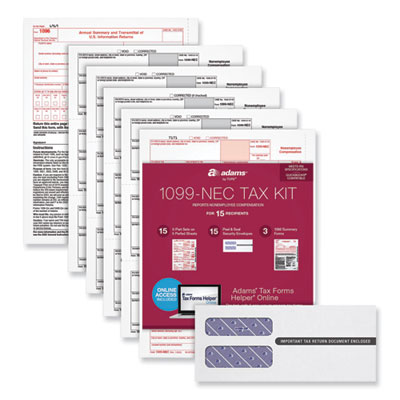

(TOP22906KIT)TOP 22906KIT – 1099-NEC Online Tax Kit, Fiscal Year: 2023, Five-Part Carbonless, 8.5 x 3.66, 3 Forms/Sheet, 15 Forms Total by CARDINAL BRANDS INC. (20/PK)

Get everything you need to report nonemployee compensation for 15 recipients. Includes 15 five-part 1099-NEC sets, three 1096 sets, 15 peel and seal envelopes and access to Tax Forms Helper Online.

$26.25

CompareGet everything you need to report nonemployee compensation for up to 15 recipients. This Adams® Online Tax Kit includes 15 Five-Part 1099-NEC sets, three 1096 summary forms, 15 peel and seal security envelopes and access to Tax Forms Helper® Online, the f

This tax kit has all you need to file 1099-NEC for 15 recipients; 15 five-part 1099-NEC sets, three 1096 sets, 15 envelopes and Tax Forms Helper® Online.

Use Form 1099-NEC to record nonemployee compensation to the IRS and recipients.

As of 2022, 1099-NEC is an IRS continuous-use form with a new fill-in-the-year date field good for multiple tax years; meets IRS specifications; accounting software and QuickBooks compatible.

This five-part 1099-NEC inkjet/laser forms print 3-up on five micro perforated sheets per copy; includes IRS scannable red ink pages with Copies A, C/1, B, 2 & C/1.

Includes access to Tax Forms Helper® Online with QuickBooks® connection (code and password enclosed in your tax forms pack).

The 1099-NEC is due to the IRS and your recipients by January 31.

(20/PK)

7187370 TOP 22906KIT