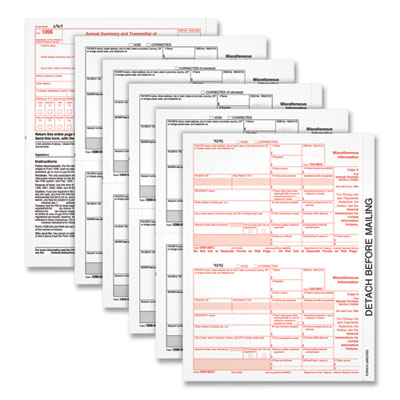

(TOP22993MISC)TOP 22993MISC – 1099-MISC Tax Forms, Fiscal Year: 2023, Five-Part Carbonless, 8.5 x 5.5, 2 Forms/Sheet, 50 Forms Total by TOPS BUSINESS FORMS (50/PK)

Use to report miscellaneous income to the IRS and your recipients. Our acid-free paper and heat-resistant inks help you produce smudge-free, archival-safe tax forms. Includes scannable red ink forms and three 1096 per pack. Meets IRS specifications. Quick

$62.58

CompareTOPS™ 1099-MISC Forms report miscellaneous income to the IRS and your recipients. Our acid-free paper and heat-resistant inks help you produce smudge-free, archival-safe tax forms. Copy A and 1096 sheets have the scannable red ink required by the IRS for

This TOPS™ forms pack provides 50, 5-part 1099-MISC inkjet/laser sets and three 1096 summary forms.

Use Form 1099-MISC to report miscellaneous income to the IRS and your recipients, including rents, royalties and other income payments.

Acid-free paper and heat-resistant inks help you produce legible, smudge-free, archival-safe records.

Print 2-up on 25 micro perforated sheets; includes IRS scannable red ink pages with Copies A, C, B, 2 and C.

Meets IRS specifications; accounting software and QuickBooks compatible.

Copy B is due to recipients Jan. 31, 2022 (if box 8 and 10 are empty) or Feb. 15 (if filled); Copy A and 1096 are due to the IRS Feb. 28; eFile by Mar. 31.

(50/PK)

7561608 TOP 22993MISC